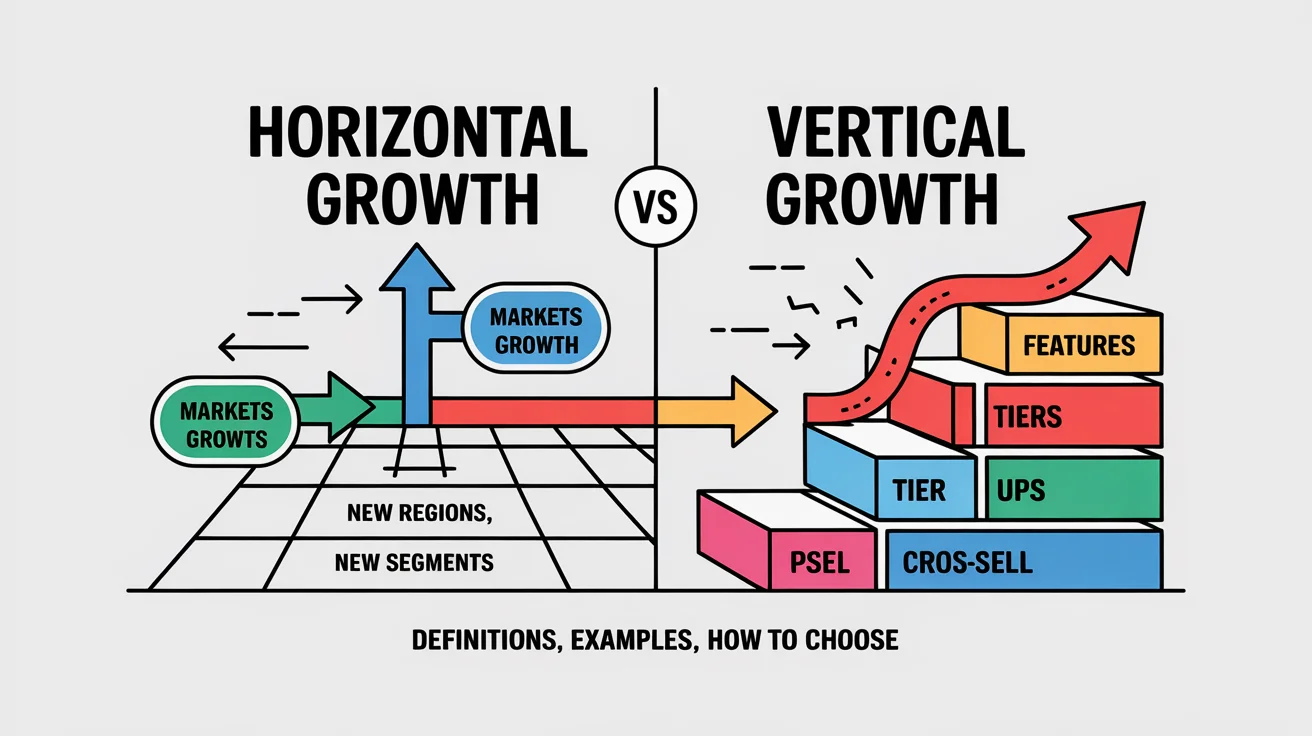

Horizontal Growth vs Vertical Growth: Meaning, Examples, Pros, Cons, and How to Choose

Growth sounds simple until you pick the wrong direction. One path helps you reach new customers fast. The other path helps you earn more from customers you already have. This guide explains both. It also helps you choose with less guesswork.

What is horizontal growth

Simple definition

Horizontal growth means you sell the same core product or service to new markets. You expand across regions, industries, or customer types. You grow by widening your reach, not by changing the core offer.

What “horizontal” looks like in real life

Horizontal growth often shows up as expansion moves. A local business opens in a new city. A SaaS tool that serves agencies starts serving law firms too. A brand that sells direct to customers adds retail partners. The product stays mostly the same. The audience changes.

Horizontal growth can also mean new channels. You may add partners, marketplaces, or a new sales motion. You may adjust pricing for a new segment. You may rewrite messaging to match a new use case. You still sell the same promise.

Horizontal growth examples

A food brand expands from one country to three. A payments app expands from freelancers to small retail stores. A marketing agency that served startups begins serving ecommerce brands. A software tool adds a new language and targets a new region.

What is vertical growth

Simple definition

Vertical growth means you go deeper in the same market. You grow by expanding what you sell. You add features, products, tiers, or services. You increase value per customer.

Common vertical growth levers

Vertical growth often starts with customer feedback. Users ask for a missing workflow. They want reporting, integrations, or automation. You build upgrades that fit the core job. You also use pricing and packaging. You create bundles, add ons, or higher tiers.

Vertical growth also includes revenue expansion. You upsell a higher plan. You cross sell a related product. You offer a premium service layer. You focus on retention and lifetime value.

Vertical growth examples

A SaaS tool adds team permissions and advanced analytics. It introduces a business plan. A gym adds personal training packages. It sells nutrition coaching. A service business adds a done for you tier. It increases average order value.

Horizontal growth vs vertical growth (the fastest way to understand it)

The core difference in one sentence

Horizontal growth wins new customers in new markets. Vertical growth earns more from the same market by expanding the offer.

Comparison table (Featured Snippet target)

| Factor | Horizontal Growth | Vertical Growth |

|---|---|---|

| Main goal | Reach new customers | Earn more per customer |

| What changes | Market, segment, channel | Product, features, tiers |

| Where you sell | New regions, industries, audiences | Current audience and market |

| Core lever | Market expansion | Upsell, cross sell, packaging |

| Cost profile | Go to market and operations | Build and product complexity |

| Biggest risk | Poor fit in new market | Feature bloat and confusion |

| Best when | Core offer is stable | Retention is strong |

| Simple example | Same product, new region | New tier for power users |

Don’t confuse horizontal growth with horizontal integration

Horizontal growth vs horizontal integration

People mix these terms. Horizontal growth means you expand reach with what you already sell. Horizontal integration is a deal move. It means you acquire or merge with similar companies. Integration aims to gain market share, distribution, or scale through ownership.

Quick examples

Horizontal growth example: a tool sells to a new industry without buying anyone. Horizontal integration example: a company buys a competitor to gain customers and reduce competition.

When horizontal growth makes the most sense

Signals you are ready

Horizontal growth works best when your core offer feels solid. Your team can deliver results consistently. Your customer support does not break under pressure. Your onboarding process works. Your product does what it promises.

A strong signal is repeatable acquisition. You know which channels bring qualified leads. You know which message converts. You can explain your value clearly. That clarity travels better into new segments.

Best fit scenarios

Horizontal growth fits when your market starts to feel crowded. It also fits when you see strong demand from nearby segments. Sometimes customers already pull you there. They ask, “Do you work with teams like us?” That question matters.

It also fits when your product solves a broad problem. The core job stays the same across groups. Only the language changes. That keeps expansion cheaper.

The biggest tradeoffs

New markets have new rules. You may face different buying habits. You may need localization. You may need legal compliance. You may need new payment methods. You may need different distribution partners.

Another tradeoff is focus. Expansion spreads attention. Teams split across regions and segments. If the core product still needs work, horizontal growth can expose cracks fast.

When vertical growth makes the most sense

Signals you are ready

Vertical growth works best when you have loyal customers. They renew. They stay. They use the product often. They trust your brand. You also see clear upgrade triggers. Some users want advanced workflows. Others want higher limits. You can package that value.

A strong signal is customer success data. You can see what power users do. You can spot which features drive retention. You can build around proven behavior.

Best fit scenarios

Vertical growth fits when your market still has room. You may already own a strong position. You can deepen it. You can raise average revenue per account. You can improve retention. You can reduce churn.

Vertical growth also fits when the cost of entering new markets feels high. If compliance or localization is heavy, vertical growth may win first.

The biggest tradeoffs

Vertical growth can add complexity. Too many features can confuse new users. Too many tiers can slow sales. A messy product can increase support tickets. It can also harm onboarding and activation.

Vertical growth can also distract your roadmap. Teams may chase requests that only a few users need. That hurts the majority. Strong prioritization matters.

How to choose the right growth strategy (decision framework)

The 60 second decision tree (Snippet target)

If you can sell the same offer to a new segment with small changes, choose horizontal growth. If you can increase value for current customers through tiers, add ons, or upgrades, choose vertical growth.

If your retention is weak, fix that first. If your positioning is unclear, fix that first. Growth does not fix unclear value.

Scoring matrix you can use today

Score each item from 1 to 5. Higher scores point toward the better strategy.

Market factors:

- Market saturation in your current segment

- Ease of reaching new segments with your current offer

- Strength of your channel access in a new segment

Business readiness:

- Clarity of your positioning and messaging

- Delivery capacity and support strength

- Budget for expansion or product work

Customer signals:

- Retention and renewal strength

- Clear upgrade triggers from user behavior

- Demand for adjacent features that fit the core job

Interpretation:

If market saturation is high and your offer travels well, horizontal often wins. If retention is strong and upgrades feel obvious, vertical often wins.

The hybrid approach

Many businesses combine both. The sequence matters. Most teams do better when they pick one primary move for 90 days. They track results. They then add the second move with control.

A common sequence is vertical first, then horizontal. Vertical strengthens the product and revenue base. It funds expansion. Another sequence is horizontal first, then vertical, when the core offer already feels mature.

Horizontal growth playbook (step by step execution)

Step 1: Pick the right market

Start with data, not vibes. List the markets you could enter. Compare them on willingness to pay, competition, and channel access. Look for segments where your current case studies already match. That reduces risk.

Choose one primary segment. Do not choose five. Focus keeps learning fast.

Step 2: Validate demand cheaply

Run small tests before you scale. Create a landing page with segment language. Offer a clear outcome. Run a small ad test or outbound test. Talk to ten people in that segment. Ask about pain, budget, and decision process.

A quick validation goal is simple. Can you book calls with the right buyers. Can you close one to three customers. If not, adjust messaging or segment choice.

Step 3: Adapt without changing your core product

Most horizontal expansion fails due to messaging, not product. Translate your value into the buyer’s language. Use their words. Adjust your examples. Build one segment specific case study.

Keep product changes small. Focus on onboarding and templates. Add lightweight localization if needed. Do not rebuild the product for a new segment yet.

Step 4: Scale with repeatable systems

Once the segment shows traction, build systems. Create a segment playbook for sales and support. Train the team on objections and use cases. Track leads, conversion, and churn by segment.

Add quality control early. Expansion errors spread fast. A weekly review protects your brand.

Vertical growth playbook (step by step execution)

Step 1: Find expansion opportunities

Start with usage data and customer conversations. Identify what power users do that others do not. Look for workflows that correlate with retention. Those workflows point to upgrade value.

Also map your cross sell pairs. They should fit the same customer job. If they do not fit, they feel pushy.

Step 2: Build the smallest valuable upgrade

Avoid big rebuilds. Ship small upgrades that solve one real problem. Focus on outcomes. A good upgrade reduces time, reduces risk, or increases clarity.

Test with a small user group. Watch adoption. Ask what feels missing. Improve with real use, not assumptions.

Step 3: Package and price it clearly

Simple packaging wins. Each tier should serve a clear type of buyer. Each tier should have a clear reason to exist. Avoid tiny differences. Buyers hate confusion.

Use limits and outcomes that match buyer needs. Use clear names. Use clear upgrade paths. Keep add ons focused.

Step 4: Launch and improve with real usage data

Measure adoption and expansion. Track support load. Watch churn. If a feature adds complexity without value, reconsider it.

Run regular reviews with product, sales, and support. Keep feedback tight. Improve the upgrade experience fast.

Metrics that prove it’s working

Metrics for horizontal growth

Track performance by segment or region. Do not blend the data.

- Lead volume by segment

- Conversion rate by segment

- Customer acquisition cost by segment

- Activation rate and time to value

- Retention by cohort in the new segment

- Win rate by channel in the new market

Metrics for vertical growth

Track revenue expansion and product adoption.

- Expansion revenue and upgrade rate

- Attach rate for add ons

- Average revenue per account

- Feature adoption for the upgrade features

- Churn rate change after upgrades

- Support tickets tied to new features

Red flags to watch

A CAC spike can signal poor segment fit. A retention drop can signal weak onboarding for the new market. Support tickets can signal product complexity. Flat adoption can signal that the upgrade solves a weak problem.

Common mistakes and how to fix them

Horizontal growth mistakes

Many teams expand too early. They enter a new market while the core product still breaks. Fix it by stabilizing delivery first. Another mistake is using the same messaging everywhere. Fix it by rewriting copy for the segment’s job and language.

Teams also underestimate compliance and localization. Fix it by doing early checks on legal needs, payment needs, and support hours. Another common mistake is spreading across too many markets. Fix it by choosing one segment for a quarter.

Vertical growth mistakes

Many teams build features that do not fit the core job. Fix it by prioritizing features that improve retention drivers. Another mistake is tier confusion. Fix it by simplifying tiers and making upgrade triggers clear.

Teams also ship upgrades too fast without quality control. Fix it by adding testing and a rollback plan. Poor customer experience also hurts upgrades. Fix it by aligning tone, support, and training.

Fix table (Skimmable)

| Mistake | Why it happens | Fix | What to measure next |

|---|---|---|---|

| Expand too early | Core offer still unstable | Stabilize onboarding and delivery first | Retention, support volume |

| Same messaging in new market | Team assumes buyers think alike | Rewrite value by segment | Segment conversion rate |

| Too many markets at once | Fear of missing out | Pick one segment for 90 days | Win rate, CAC by segment |

| Feature bloat | Every request feels urgent | Prioritize retention drivers | Adoption and churn |

| Confusing tiers | Pricing grew over time | Simplify packaging | Upgrade rate, sales cycle |

| Shipping without QA | Speed pressure | Add reviews and checks | Bug rate, tickets |

Horizontal growth in careers (optional but useful)

What horizontal growth means for individuals

In careers, horizontal growth means expanding skills, scope, and influence. You take on adjacent work. You build cross functional strength. You become useful in more situations. Titles may not change, but capability grows.

How managers support it

Managers can assign stretch projects. They can offer mentorship. They can rotate ownership across teams. They can reward skill building, not only promotions. This keeps talent engaged and reduces stagnation.

Skills based organizations (brief)

Many companies now map skills and match people to projects. This supports internal mobility. It also helps employees grow without leaving.

FAQs

What is horizontal growth in simple terms?

Horizontal growth means selling the same product to new markets, regions, or customer groups.

What is vertical growth in simple terms?

Vertical growth means growing by adding features, tiers, products, or services in the same market.

Is horizontal growth the same as horizontal integration?

No. Horizontal growth expands reach. Horizontal integration uses acquisitions or mergers with similar companies.

Which is cheaper, horizontal or vertical growth?

It depends. Horizontal often costs more in go to market. Vertical often costs more in product work.

Which is riskier, horizontal or vertical growth?

Both carry risk. Horizontal risks poor market fit. Vertical risks complexity and low adoption.

Can a business do both at the same time?

Yes, but focus matters. Many teams win by choosing one main move for 90 days.

What are examples of horizontal growth in SaaS?

A tool targets a new industry. It expands into a new region. It adds a new sales channel.

What are examples of vertical growth in SaaS?

A tool adds advanced analytics. It launches a higher tier. It sells add ons and bundles.

What metrics matter most for horizontal growth?

Conversion rate and retention by segment matter most. CAC by segment also matters.

What metrics matter most for vertical growth?

Upgrade rate, adoption of upgrade features, and expansion revenue matter most.

Conclusion

Horizontal growth expands into new markets with the same offer. Vertical growth goes deeper in the same market with a bigger offer. Pick the strategy that matches your data and capacity. Commit for 90 days. Measure the right metrics. Adjust with what you learn.